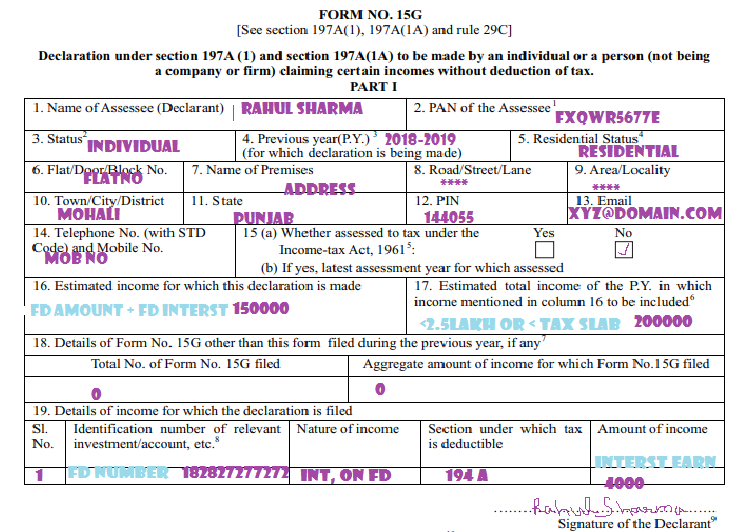

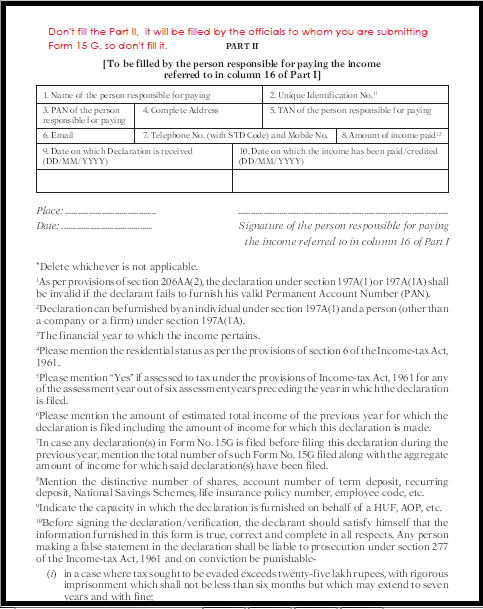

TDS is deducted from the income you earn from corporate bonds, which is more than Rs. 2.5 lakh, you can submit Form 15G or Form 15H to avoid the TDS deduction. However, if your total annual income is under the threshold limit of Rs. When you withdraw your Employees’ Provident Fund (EPF) before the completion of 5 yrs, and the withdrawal amount is more than Rs. Hence, filing an income tax return will help you get a refund.Īpart from saving your interest income if it meets the eligibility criteria, Form 15G and Form 15H can be used in several places, including, For EPF withdrawals Banks cannot refund TDS to you as they have already transferred it to the Income Tax Department.

The total interest income should not exceed the threshold limit of Rs. You must be aged 60 yrs or above to use this form. You must be below 60 yrs to use this form. Let’s look at the difference between them. However, it applies to senior citizen taxpayers. 2.5 lakh.įorm 15G is often confused with Form 15H.

Form 15G for PF withdrawal – a step-by-step processĮligibility criteria and where to get Form 15G?įorm 15G can easily be found and downloaded for free from the official EPFO portal and all major Indian banks’ websites.Where can Form 15G and Form 15H be used?.What to do when you forget to submit Form 15G or Form 15H?.When should you submit Form 15G or Form 15H?.Eligibility criteria and where to get Form 15G?.

0 kommentar(er)

0 kommentar(er)